It is important to identify if you will need to register in The Register of Persons Holding a Controlled Interest in Land (RCI) before creating an account. This article will help you find out if you need to make an entry in RCI.

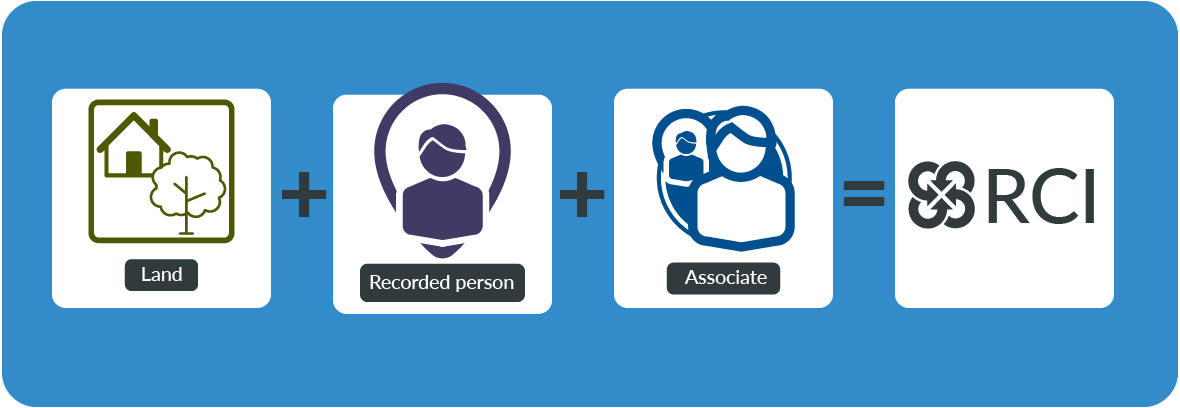

There are three different parts to RCI. These are:

- the land

- the owners and tenants of land, known as the recorded person

- people that might have a controlling interest in land, known as associates

![]()

![]()

![]()

Land owners or tenants

![]()

![]()

Not all owners and tenants of land will require to make an entry in RCI. This only applies to those who are classed as a recorded person.

For RCI a recorded person is someone who:

- owns land in Scotland and has an associate with a controlling interest over the land, or

- tenants land on a registered or recorded lease of more than 20 years in Scotland and has an associate with a controlling interest over the land

Subjects which form a separate legal tenement, such as minerals or salmon fishings, are within scope of the RCI. In the RCI the term “land” includes buildings and other structures, seabed and other land covered by water and separate legal tenements, such as minerals or salmon fishings.

Several conditions need to be met to be classed as a recorded person and there are exemptions. If you do not meet these conditions or are exempt then you do not need to make an entry in RCI.

More information can be found in the recorded persons article.

The Regulations are not intended to capture those who own their own home, where there is no one who has significant influence or control over them.

Online support tool

Our online support tool will help provide you with an indication as to whether or not you are in scope of RCI as a recorded person.

Access the RCI online support tool.

Agricultural or crofting tenancies

Although unlikely for agricultural or crofting tenancies, only a lease that is more than 20 years and recorded or registered in sasines or the land register falls within scope of RCI.

The majority of crofts would not be in scope of the RCI Regulations. Whilst there may be certain limited scenarios where, for example, a trust is on the title as the owner of the croft, and depending on the arrangements for control over decision making, they may be in scope, it is unlikely that more traditional crofting landlords and tenants are captured.

Docquet transfers

A docquet transfer following the death of an owner or tenant does not engage the RCI regime. As there has been no actual transfer of title there is no new owner or tenant entered in the land register or in sasine registers that could be a potential recorded person.

Identifying associates

![]()

An associate is a person with significant influence or control over the recorded person. Associates will be:

- persons who have certain contractual or other arrangements with an individual who owns or tenants land on a registered or recorded lease

- partnerships and persons who own or tenant land on their behalf

- trusts and persons who own or tenant land as trustees of a trust

- persons responsible for the general control and management of the administration of an unincorporated body of persons who own or tenant land on their behalf

- overseas entities

You can find out more information on:

Who is exempt from RCI

Those who fall into the following categories are subject to other transparency regimes. For this reason, they are not a recorded person and do not need to make a submission to RCI. They can still be an associate as their details may be submitted to RCI by a recorded person.

Charitable organisations

Charitable incorporated organisations (CIOs) and Scottish charitable incorporated organisations (SCIOs) are not subject to the Regulations. CIOs are active in England and Wales – SCIOs are their Scottish equivalent.

As the information is already publicly available, the regulations do not require SCIOs to report in the register. CIOs follow similar structures and accordingly are also not required to report to the new register.

Register of People with Significant Control

Those who report into the Register of People with Significant Control (PSC) regime, held by Companies House being:

- UK companies,

- Limited Liability Partnerships (LLPs),

- Scottish Limited Partnerships (SLPs),

- Societas Europaeae and

- Scottish partnerships where all the partners are limited companies

- certain overseas entities

- certain UK body corporates

Freedom of information

Public authorities to which the Freedom of Information (Scotland) Act 2002 or the Freedom of Information Act 2000 apply will not be required to report. These Acts apply widely to public sector bodies including:

- Ministers

- non-departmental public bodies

- local authorities

- health boards

In each of these cases, the control of the organisation will already be transparent through legislation. The exemption only applies to bodies that are legally bound to comply with the Freedom of Information legislation. Bodies that do so voluntarily are not exempt from RCI.

Certain bodies who report to the Financial Conduct Authority for publication in the Register of Mutuals are also exempt.

A complete list of the categories of exemption can be found in Schedule 2 of the RCI regulations.

A registration of an overseas entity in the Register of Overseas Entities (ROE) will not remove any duty on the overseas entity should they be required to register in RCI. Overseas entities that are in scope of RCI must register irrespective of ROE and make arrangements to comply with RCI legislation ahead of the transition period ending and criminal offences coming into force in April 2024.

Check if you need to make an entry

The following sections contain the conditions needed to make an entry.

- You are the named owner of the land (on the land register or sasines)

- The land is in Scotland

- There are persons who are not named owners that have a controlling interest over the land, and they do not fall into one of the excepted criteria

- You are not subject to a transparency regime, for example, if the land is owned through a SCIO

If everything in the list applies to you, it is likely you will need to register with RCI

- You are the tenant of the land under a registered or recorded lease of more than 20 years

- The land is in Scotland

- There are persons who are not the tenants that have a controlling influence over the land, and they do not fall into one of the exempted criteria

- You are not subject to a transparency regime, for example if the land is owned through a Scottish Charitable Incorporated Organisation (SCIO)

If everything in the list applies to you, it is likely you will need to register with RCI

There will be cases where the land is held by trustees or on behalf of an unincorporated body and where, due to the passage of time, the land register or Register of Sasines lists persons who no longer have any legal connection with the property as owners or tenants.

The most likely example of this situation is where the trustees have resigned or are deceased. Although they still appear on the Land Register or Register of Sasines, they have no connection with the trust or unincorporated body.

Current trustees or those holding on behalf of an unincorporated body are to be treated as owners or tenants. This is outlined in Regulation 23A of the RCI regulations.

This covers the following situations:

- Land owned/tenanted by trustees of a trust and all of the trustees named have ceased to be trustees

- Land owned/tenanted by trustees or members of an unincorporated body and all of the trustees/office bearers named (ex officio or otherwise) have ceased to be trustees

- Land owned/tenanted by ex officio trustees but only the office is named (where the office bearers names do not appear)

In these circumstances, the current trustees or office bearers would need to register in RCI and be registered as both a recorded person and associate. It must be made clear in the submission to the RCI that an entry is being made on this basis.

If everything in the relevant section applies to you, it is likely you will need to register with RCI, unless you are trustee/office bearer and have updated or will be updating your land registered title by rectification or registration to show the current trustees/office bearers.

If you are in any doubt, it is advised that you seek professional guidance before proceeding.

Registering with RCI

Registration with RCI opened 1 April 2022. From this date, all existing recorded persons have a two year period to register, until 1 April 2024. Offence provisions in the Regulations will apply following this period.

Offence provisions in the Regulations will apply following this period. More information on offences provisions can be found in the offences article.

To register with RCI you will need to either request access through online services or create an account with RCI. More information can be found in the creating an RCI account article.

Information needed for making an entry with RCI

For RCI there are certain details needed about the land, recorded person and associate.

Information about the owner or tenant

![]()

Details of the recorded person required for RCI includes:

- the name and address of a recorded person, and if relevant, their registered number (for example, company number)

- the title number of the land, or where the land is not in the land register, a description of the land enough to allow it to be identified

- details of the capacity in which the recorded person owns or leases the land. This would include, for example, where an individual owns the land in their capacity as a trustee

- the required details in relation to each associate or, where a security declaration has been made, a statement of that instead

Information about the land

![]()

There are two main types of register for land in Scotland.

The Land Register of Scotland

The land register is the Register of Scotland’s main register. It records ownership of land and property in Scotland.

General Register of Sasines

The sasine register is the oldest national public land register in the world, dating back to 1617.

Some land may also be held in the Particular Register of Sasines or the Burgh Registers.

Land and property that has been transacted upon from about 1980 will most likely be held in the land register.

In the land register

Land and property can be searched for by using Scotland's Land Information Service (ScotLis) to check if it is on the land register.

If the land is in the land register, the title number will be needed.

Not in the land register

Land not in the land register is most likely to be held in the General Register of Sasines, but could be held in the Particular Register of Sasines or the Burgh Registers.

If the land is not in the land register, we'll need one of the following:

- the land address, for example, postcode or street name

- a description of the land and an indication of the location of the land on a map using a “pin drop” function

Guidance on describing land is available in the describing land article.

Ownership details

As well as information on where the land is located and if it’s on the land register or not, RCI requires information about how land is owned or tenanted on a registered or recorded lease of more than 20 years.

Information needed for this is:

- if the recorded person is the owner of the land or a tenant

- if the recorded person is an overseas entity or a partnership

- if the recorded person is an individual who has contractual or other arrangements with associates

- if the recorded person owns or tenants the land on behalf of a partnership, a trust, or an unincorporated body and the name of the partnership, trust, or unincorporated body

Trusts and unincorporated bodies

If the recorded person needs to register in RCI because all trustees of the trust or office bearers of unincorporated bodies named as owner or tenant have ceased to be trustees or office bearers, they must make a statement to this effect during the registration process. They can do so by answering "no" to the question "Are any of the current trustees named on the land register or sasine register title". The recorded person must also be added as an associate at the same time. This situation arises because of regulation 23A.

Guidance on this situation can be found in the recorded person, trusts , and unincorporated bodies articles.

Information about persons with a controlling interest

![]()

Details of the associate required for RCI includes:

- the date (month and year) on which the association with the recorded person started or a statement that the date is not known.

- name

- contact address

- date of birth, this will not be shown on the register and is only needed when the associate is an individual

- registered number (e.g. company number), only where the associate is a non-natural person (for the purpose of identifying them)

- unique reference number, known as the associate reference number, these are allocated after an associate’s details are first entered in RCI

- the paragraph of Schedule 2 that applies only where the associate is an entity listed in Schedule 2 transparency regimes

Register of overseas entities (ROE)

A registration of an overseas Entity in ROE will not remove any duty on the overseas entity should they be required to register in the RCI.

When RCI and ROE were initially in policy development the view of both the Scottish Government and the UK Government was that double reporting should be avoided where possible. Our current understanding is that this has not changed and that the Scottish Government will consider the extent of duplication once the register has had time to embed and then decide whether it is appropriate to amend the RCI regulations.

It's important to note that in the meantime overseas entities that are in scope of RCI must register irrespective of ROE and make arrangements to comply with RCI legislation ahead of the transition period ending and criminal offences coming into force in April 2024.

Additional information on RCI regulations

The Scottish Property Professional Support Lawyers Group (SPPSLG) has prepared an article on the RCI regulations 2021 working with Registers of Scotland.

Find out more about the SPPSLG article

Accessing RCI

You can create or update entries in RCI on the RCI website.

More information on creating an account can be found in the how to create an account article.

| Next |