What is a trust

Land in Scotland may be placed in a trust:

- to deliver benefits to family members and ultimately to be inherited by a later generation

- on behalf of investors and to support a commercial venture

- to deliver charitable benefits to a specific group or to the population at large

Parts of a trust

Truster

The person who sets up a trust and places the assets within it is known as the truster.

Trustee

The trustees are people who become the legal owners of assets within the trust.

Trustees are under fiduciary duties to act in the interests of the beneficiaries. These duties will guide and influence their decision making. The trust deed may also make requirements of the trustees and thereby influence their decision making. For example, it may specify that a certain piece of land is to be kept as a garden in perpetuity, or that a building must continue to fulfil a certain role.

Beneficiaries

Beneficiaries receive certain benefits as set out in the trust deed. This may include a wide group of people, for example, a local community, who are to benefit from a charitable trust, or a family member who is to benefit from land placed in trust by a relative.

Trust structures

Trusts can be subject to very unusual structures including truster-as- beneficiary trusts, or that nominee trustees can be put in place to obscure the retention of control by the truster.

Purpose of trusts

The essential feature of a trust is the holding of land by one person or group of persons for defined purposes. Those purposes will frequently be intended to benefit identified or identifiable persons, the beneficiaries, but that is not an essential feature of the trust. Any person who can competently hold property and deal with it may act as a trustee.

The trustee who holds the property is given powers to manage the property and, usually, to dispose of it in appropriate circumstances.

A trust provides a means whereby one person can manage the property of another. It is used extensively in commercial transactions in modern Scottish practice. It is widely used to hold property for children and for adults subject to disability. It is also a common means of holding and managing the property of charities and other bodies set up for public purposes.

How trusts are referenced in the land register

In the land registers, land that is held in trust will show the trustees as the legal owners of the land as a result of their position as a trustee. The title may be in the name of “The trustees of Mr Smith and their successors in office” or in the name of the individual trustees. Where the trustees are named, the land register will show their names and addresses and the title may be updated to reflect changes in the trustees. A land register title may also show the individual or entity on whose behalf they hold the land. This is not, however, a legal requirement.

Trustees tend not to update the land register to reflect changes in the trustees. For example, if Sam is the legal owner of a piece of land as a result of their position as a trustee, the land register may show the legal owner as ‘Sam and their successors in office’. If Sam is no longer a trustee having been replaced by Ali, that will not be apparent from the land register unless an update is requested. Where trustees hold their position ex officio, the title can be updated by rectification.

Trustees that should register in RCI

A trustee who owns or tenants land, or does so on behalf of a trust, should register in RCI if the person with a controlling interest, known as the associate is:

- a trustee but not an owner or tenant in the land register or sasines register, or

- an individual with significant influence or control over a relevant entity which is a trustee of the recorded person, or

- an individual who has the right to exercise or actually exercises significant influence or control over the recorded person or the trust

Significant influence or control in relation to trusts

Those who have a significant influence or control in a trust include persons who:

- have the right to appoint or remove a trustee, other than by application to the court, this power may typically be provided for in the trust agreements of commercial trusts

- have the right to direct the distribution of assets or funds, or to direct investment decisions of the trust, this may be provided for in a trust agreement

- have the right to amend the trust deed

- have the right to revoke the trust, this may include of-age sole beneficiaries of a bare trust who can unilaterally revoke the trust

- can significantly influence or control the decision-making of the trust without holding a formal governance position within the trust

Exceptions

A person is not an associate if their relationship to the trust is only that of:

- a paid professional advisor to the trust, for example, a solicitor or an accountant

- a creditor of the trust, for example, the holder of a standard security

- a member of the judiciary presiding over proceedings in connection with the trust, or

- a member of a body that can exercise significant influence or control by virtue of a statutory function

If the trust is created for the purposes of insolvency or sequestration it will not have to register in RCI.

Part 3 of Schedule 1 of the RCI regulations will help you to determine if you have an associate and will be required to register.

Beneficiaries as associates

RCI does not require the registration of beneficiaries. This is because a completely financial interest does not equate to engagement in the governance of a landowning body or entity. Where beneficiaries are engaged in the control or governance of the trust, then it is expected they would be registered as associates on that basis.

Overseas entities as trustees

Sometimes an overseas entity will own or tenant land as a trustee of a trust. In these cases, the overseas entity will require to determine and disclose all of their associates. They may have associates because they are an overseas entity and have associates because they are a trustee. Where an overseas entity is acting as a trustee of a trust, they must register in RCI in the overseas entity category rather than choosing trustee.

Trusts that are subject to a transparency regime

Trusts that are subject to other transparency regimes cannot be a recorded person, however, they can still be an associate. Schedule 2 of the RCI regulations shows the entities which are subject to other transparency regimes and are therefore do not need to register in RCI.

If you fall within the list of transparency regimes you are out of scope from being a recorded person and will not have to register in RCI. This is the case irrespective of the capacity you act in. This means if, for example, a UK company is the owner or tenant the fact that they hold the property as trustee on behalf of an unincorporated body will not bring them in the scope of the RCI.

Trusts which are registered in HMRC’s Register of Trusts are not exempt from any requirement to register in RCI

Updating the land register title

If the land register title does not show the current trustees as the owner or tenant of land it is recommended the trustees update the title.

This will mean that an entry to RCI will not be required, provided there is no other person who has significant influence or control over the owner or tenant, or trust. The land register title will show the current trustees and be transparent.

The appropriate course of action for updating the land register title will depend on whether trustees are being:

- removed because of death or resignation

- added because of their ex officio role on appointment to that office or,

- added because they have been assumed as new trustees

Updating the land register will involve rectification or registration.

Rectification of the land register title will be possible when:

- removing trustees who have died or resigned

- adding new trustees who are ex officio, following their appointment to that office

Guidance on how to make and submit a request for rectification of the land registered title can be found in the inaccuracy and rectification article.

Rectification is not possible for land that is held in the sasine registers.

Registration of a deed, most likely a notice of title, in the land register will be required to add new trustees, excepting ex officio trustees.

Where some trustees resign and new trustees are assumed, a combination of rectification to remove outgoing trustees from the title and registration for the new trustees would be required.

When existing owners or tenants are no longer associated with land

There will be cases where the land is held by trustees and the land register or register of sasines lists persons who no longer have any legal connection with the property as owners or tenants. The most likely example of this situation is where the trustees have resigned or are deceased. Although they still appear on the land register or register of sasines they have no connection with the trust.

Current trustees or those holding on behalf of an unincorporated body are to be treated as owners or tenants. This is outlined in regulation 23A of the RCI regulations.

This applies when land owned/tenanted by:

- trustees of a trust and all the trustees named have ceased to be trustees

- trustees or members of an unincorporated body and all of the trustees/office bearers named, ex officio or otherwise, have ceased to be trustees

- ex officio trustees but only the office is named, where the office bearers names do not appear

In these circumstances the current trustees or office bearers would need to register in RCI and be registered as both a recorded person and associate. They must answer "no" to the question "Are any of the current trustees named on the land register or sasine register title" and add the recorded person as an associate.

This means the current trustees or office bearers will be entered twice in their submission, first as a recorded person and secondly as an associate. They should add the recorded person as an associate first and then add any other associates.

The date of association will be the date the current trustee or office bearer became trustee or office bearer, of the land, for the trust.

The recorded person does not need to notify the other associates that are also both recorded persons and associates of the submission to the RCI.

What information does RCI need

For recorded persons within a trust, RCI requires:

- their first and last name

- the name of the trust

- a contact address

- information on how they own the land – are they owner or tenant, and do they own the land in a certain capacity, for example, as trustee

For associates, RCI requires:

- their name

- their date of birth, this is for RoS internal purposes only and will not be shown on the register

- the date the association between the trust as recorded person and the associate started

- a contact address or registered office

- their unique reference number, known as the Associate Reference Number, these are allocated after an associates details are first entered in RCI

- information on whether they are subject to a transparency regime

- name of trust, this is optional

Examples of recorded persons and associates within a trust

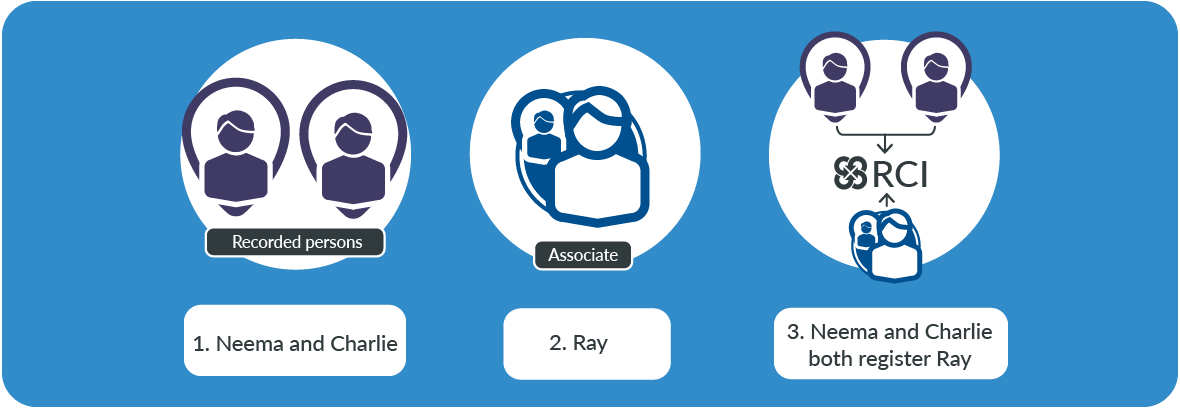

Example 1

The following is an example of a trust that has two trustees named on the title sheet of a property, with third trustee who is not.

- Neema and Charlie are the current trustees of the Bloomfield trust and are named owners on the land register.

- Ray is not named as on owner on the land register but has the right to appoint and remove trustees.

- For RCI, Nemma and Charlie will need to separately register as recorded persons. Both Neema and Charlie will need to register Ray as an associate.

Example 2

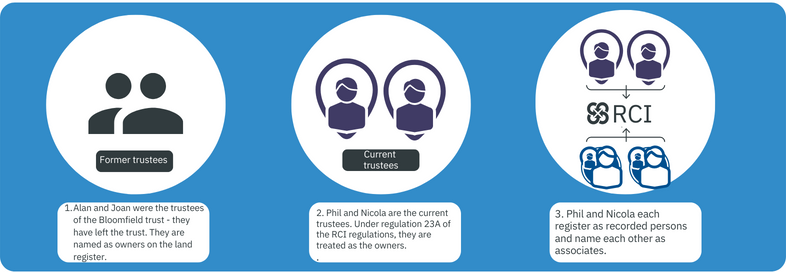

The following example illustrates a trust where the trustees named on the title sheet of a property are no longer present.

- Alan and Joan are the trustees of the Bloomfield trust. They are named as owners on the land register. Alan and Joan both left the trust a number of years ago. The land register title was not updated when they left.

- Phil and Nicola are the current trustees. Under regulation 23A of the RCI regulations, Phil and Nicola are treated as the owners.

- For RCI, Phil and Nicola will need to separately register as recorded persons. Because they are not on the land register title they are also associates. Both Phil and Nicola will each need to register one another as an associate. When Nicola registers as recorded person, she will first add herself as an associate then add Phil as an associate. When Phil registers as recorded person, he will first add himself as an associate then add Nicola as an associate.

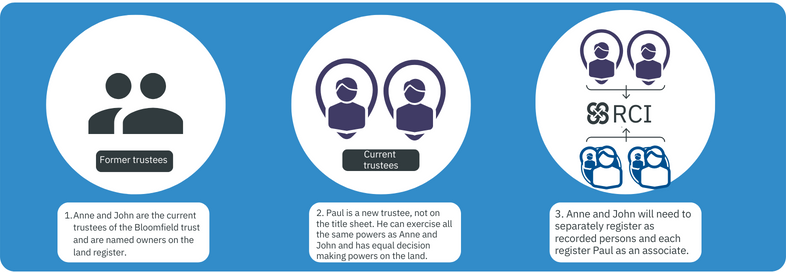

Example 3

The following example illustrates a trust that has two trustees named on the title sheet of a property. A third trustee who does have significant influence or control is not on the title sheet.

- Anne and John are the current trustees of the Bloomfield trust and are named owners on the land register.

- Paul is a new trustee. He is not on the title sheet. Paul can exercise all the same powers as Anne and John. He has equal decision making powers on the land owned by the trust.

- For RCI, Anne and John will need to separately register as recorded persons. Both Anne and John will need to register Paul as an associate.

Example 4

The following example illustrates a trust that has two trustees named on the title sheet which are registered UK companies. Registration is not required in RCI as the companies are subject to another transparency regime, namely the People with Significant Control Register.

- Yellow Company (UK) Limited and Green Company (UK) Limited are the current trustees of the Bloomfield trust and are named owners on the land register.

- As UK companies, Yellow Company (UK) Limited and Green Company (UK) fall into the list of persons who report to other transparency regimes in schedule 2 of the RCI regulations.

- Even though Yellow Company (UK) Limited and Green Company (UK) Limited are acting in their capacity as trustees of the Bloomfield trust the fact that they fall into the list of persons who report to other transparency regimes in schedule 2 of the regulations means that they are out of scope of RCI due to being UK companies. They do not need to register.

Diagrams setting out examples of how the RCI regulations apply where land is owned or leased by trustees can also be found in the Scottish Government’s explanatory document.

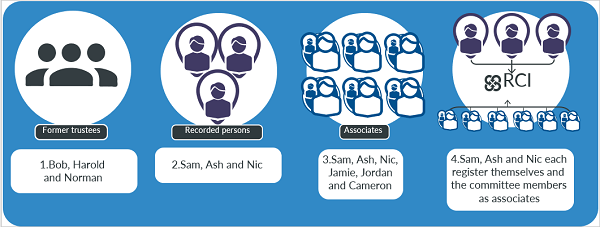

Example 5

The following example illustrates a village hall established as a trust where the trustees named on the title are no longer present. We understand this is a common scenario for a village hall but it is important that the village hall trustees check whether they are trustees of a trust or trustees of an unincorporated body.

- Bob, Harold and Norman are the trustees of the Durness Village Hall Trust named on the sasines register. They were trustees when the village hall was built in 1930. They have all deceased and there are now different trustees.

- The current trustees of the Durness Village Hall Trust are Sam, Ash and Nic. In RCI, they are treated as the owners under regulation 23A.

- There is also a management committee of office bearers that are responsible for running the village hall and can appoint trustees. For RCI these three office bearers, Jamie, Jordan and Cameron, would be associates.

- It is the trustees who are the owners rather than the trust itself. Therefore in RCI the recorded person will not be Durness Village Hall Trust. Rather, the recorded persons are the current trustees.

- For RCI, Sam, Ash and Nic will need to separately register as recorded persons. Because they are not on the sasines register title they are also associates. Sam, Ash and Nic will each need to register one another as an associate. The committee of office bearers are also associates.

- When Sam registers as recorded person he will add himself and Ash and Nic as associates and also the office bearers Jamie, Jordan and Cameron. When Ash registers as recorded person he will add himself and Sam, Nic, Jamie, Jordan and Cameron as associates. When Nic registers as recorded person she will add herself and Sam, Ash, Jamie, Jordan and Cameron as associates.

Additional information on RCI regulations

The Scottish Property Professional Support Lawyers Group (SPPSLG) has prepared an article on the RCI regulations 2021 working with Registers of Scotland.

Find out more about the SPPSLG article

| Previous | Next |