What is a partnership?

The term partnership covers the situation where two or more persons agree to conduct a business on the basis of dividing the profits and sharing the losses between them. The definition is “the relation which subsists between persons carrying on a business in common with a view of profit”. Person includes every person recognised as a person in law so that a partnership could be formed between a natural person and a non-natural person such as a company or partnership.

Structure

There must be at least two persons to form a partnership, though there is no specified maximum number of partners. A business carried on by one person alone, though in a name indicating a firm, is not a partnership.

Purpose

A partnership must be formed for the purpose of carrying on business, with the intention of making profits and therefore cannot be formed for charitable or other non-profit-making objectives, such as acting as mere nominees holding assets for the true owner. Associations formed for purposes other than profit, for example clubs, cannot be partnerships.

Normally the partnership is constituted by a written contract between the partners, setting out the trading name of the firm, the nature of the business, what each partner will put into the business, how the profits will be shared etc. Businesses such as farms or shops are often operated by partnerships. In many professions, for example law and medicine, a partnership is the almost invariable method of providing general practice to clients.

Partnerships as an owner of land – are they in the scope of the Register of Persons Holding a Controlled Interest in Land (RCI)?

Where all the partners in a Scottish limited partnership (SLP) or a Scottish limited liability partnership (LLP) are limited companies, SLPs and LLPs are required to report information to the people with significant control register (PSC). There are, however, no equivalent reporting requirements on Scottish partnerships where at least one partner is an individual or on general partnerships governed by English law.

Partnerships under English law do not have legal personality and therefore cannot be the legal owner of land or holder of a lease on their behalf. Scottish partnerships do have legal capacity and can own the land directly. It is understood that they usually do not hold title to land directly, and instead, one or more of the partners will typically hold the land in ‘trust’ for the partnership. Therefore, English and Scottish partnerships are treated in the same way in the RCI regulations.

How to determine if you should register in RCI

You should register in RCI if the person who owns or tenants the land, known as the recorded person, does so as a partner in a partnership or on its behalf, or is a partnership, and

- There is a person, the associate, who:

- is a general partner of the recorded person, but NOT an owner or tenant in the land register or sasines register, OR

- is a general partner of another partnership which is (of itself) a partner of the recorded person, OR

- is an individual who has significant influence or control over a relevant entity which is a partner of the recorded person, OR

- is an individual who has the right to exercise, or who actually exercises, significant influence or control over the recorded person or a partnership in which the recorded person is a partner.

If you fall within the list of transparency regimes you are out of scope from being a recorded person and will not have to register in RCI. This is the case irrespective of the capacity you act in. This means if, for example, a UK company is the owner or tenant the fact that they hold the property as a partner will not bring them in scope of the RCI.

Overseas entities as partners

Sometimes an overseas entity will own or tenant land as a partner in a partnership. In these cases, the overseas entity will require to determine and disclose all of their associates. They may have associates because they are an overseas entity and have associates because they are a partner. Where an overseas entity is acting as a partner, they must register in RCI in the overseas entity category rather than choosing partner.

Significant influence or control in relation to partnerships

Those who have a significant influence or control in partnerships include persons who:

- have the right to unilaterally take or veto decisions about the governance and running of a partnership, or

- have the right to appoint or remove any partners of a partnership without application to a court, or

- are able to influence the decision making of a partnership without holding any formal governance position within the partnership, particularly in respect of the partnership’s dealings with land

Exceptions

RCI does not apply to a person where that person’s relationship to the partner or partnership is only that of:

- a paid professional advisor to the partnership (such as a solicitor or an accountant),

- a creditor of the partnership (such as the holder of a standard security),

- an administrator of the partnership in insolvency proceedings, or

- a member of the judiciary presiding over proceedings in connection with the partnership.

Part 2 of Schedule 1 of the RCI regulations has more information about land held by, or on behalf of, partnerships.

What information does RCI need?

If the partner or partnership is the owner or tenant, known in RCI as a recorded person, information is needed on:

- the partner's name

- the name of the partnership

- a contact address

- how they own the land - are they owner or tenant, and do they own the land in a certain capacity, for example, as a partner

For the person with controlling interest over the recorded person, known in RCI as an associate, information is needed on:

- unique reference number, known as the Associate Reference Number, if previously entered in RCI these are already allocated to the associate

- their name

- their date of birth, this will not be shown on the register

- if appropriate, what type of entity it is, for example, a partnership or overseas entity

- a contact address or registered office

- the date the association between the recorded person and the associate started, if known

- if the associate is subject to a transparency regime

When existing owners or tenants are no longer associated with land

There will be cases where the land is held by those acting in the capacity of partners and trustees of a partnership and the land register or register of sasines lists persons as partners who no longer have any legal connection with the property as owners or tenants. The most likely example of this situation is where the partners have resigned or are deceased. Although they still appear on the land register or register of sasines they have no connection with the partnership.

Current partners or those holding on behalf of a partnership are to be treated as owners or tenants, if the current partners are also trustees and are holding the land in trust for the partnership then they fall within regulation 23A of the RCI regulations because of the trust relationship.

This applies when land is owned/tenanted by partners and trustees of a partnership and all the partners named have ceased to be partners.

In these circumstances, the current partners and trustees of a partnership would need to register in RCI and be registered as both a recorded person and associate. They must answer "no" to the question "Are any of the current trustees named on the land register or sasine register title" and add the recorded person as an associate.

This means the current partners and trustees will be entered twice in their submission, first as a recorded person and secondly as an associate. They should add the recorded person as an associate first and then add any other associates.

The date of association will be the date the current partner became a partner and trustee of the partnership.

The recorded person does not need to notify the other associates that are also both recorded persons and associates of the submission to the RCI.

Example of a partnership and RCI

Example 1

The following example illustrates a partnership in RCI.

- Elliot, Jean and Morgan are partners of the Dunston Veterinary Group and are named owners on the land register.

- They have a 4th partner, Kelly, who is not named as an owner on the land register. As Kelly has a significant influence over the decisions of the business, including the land or property owned, they are an associate.

- Elliot, Jean and Morgan are the recorded persons and each need to register Kelly as their associate in RCI.

Example 2

The following example illustrates a partnership in RCI that includes companies. Registration is not required in RCI as the companies are subject to another transparency regime, namely the People with Significant Control Register.

- Blue Company (UK) Limited, Yellow Company (UK) Limited and Green Company (UK) Limited are partners of the Dunston Partnership. All three partners are named owners on the title sheet.

- Blue Company (UK) Limited, Yellow Company (UK) Limited and Green Company (UK) Limited are subject to the People with Significant Control Register. This is a transparency regime.

- Even though Blue Company (UK) Limited, Yellow Company (UK) Limited and Green Company (UK) Limited are acting in their capacity as partners of the Dunston Partnership they are not required to register as recorded persons in RCI. This is because they are subject to a transparency regime outlined in schedule 2 of the RCI regulations.

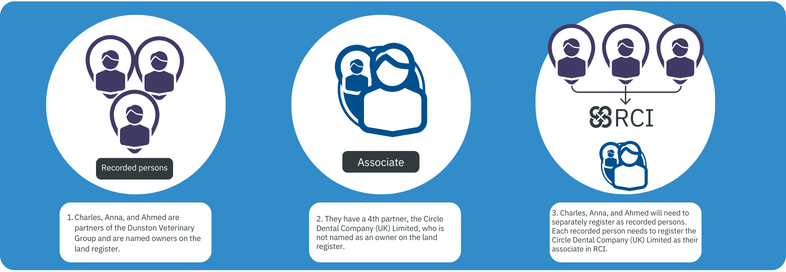

Example 3

The following example illustrates a partnership in RCI which includes a partner who is a UK company and isn’t named on the title sheet.

- Charles, Anna, and Ahmed are partners of the Dunston Veterinary Group and are named owners on the land register.

- They have a 4th partner, the Circle Dental Company (UK) Limited, who is not named as an owner on the land register.

- Charles, Anna, and Ahmed will need to separately register as recorded persons. Each recorded person needs to register the Circle Dental Company (UK) Limited as their associate in RCI.

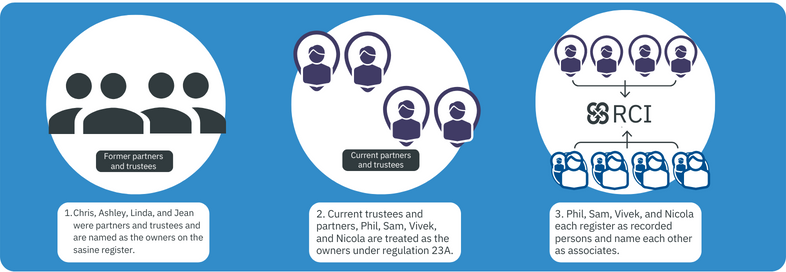

Example 4

The following example illustrates a partnership where all the partners named as owners are no longer present.

- Chris, Ashley, Linda, and Jean were partners and trustees of the Dunston Medical Partnership and are named as the owners on the sasine register. They all ceased to be partners and trustees and left the partnership several years ago. However, the title in the sasine register still shows Chris, Ashley, Linda, and Jean as owners.

- Phil, Sam, Vivek, and Nicola are the current partners and trustees of the Dunston Medical Partnership. Under regulation 23A of the RCI regulations, Phil, Sam, Vivek, and Nicola are treated as the owners.

- For RCI, Phil, Sam, Vivek, and Nicola will need to separately register as recorded persons. Because they are not named as owners on the sasine register they are also associates. They will each need to register one another as an associate.

- When Phil registers as a recorded person he will add himself, Sam, Vivek, and Nicola as associates. When Sam registers as a recorded person he will add himself Phil, Vivek, and Nicola as associates. When Vivek registers as a recorded person he will add himself Phil, Sam, and Nicola as associates. When Nicola registers as a recorded person she will add herself Phil, Sam, and Vivek as associates.

Example 5

- Alan and Joan are a farming partnership who own their farm but the title is taken in their names as husband and wife with no reference to the farming partnership in the title.

- The farming partnership consists of Alan and Joan.

- Alan and Joan take on a new partner, Harry, in the farming partnership, the title is not updated.

- As there is a partner in the farming partnership, Harry, who is not named on the title it is necessary to make a submission to the RCI.

- Alan and Joan, who are named on the title, are recorded persons and Harry is their associate.

- Alan and Joan must each make a separate submission to the RCI register and they each need to name Harry as their associate.

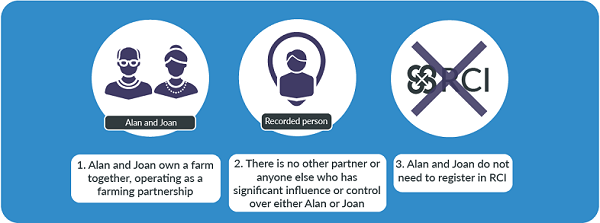

Example 6

- Alan and Joan are a farming partnership who own their farm but the title is taken in their names as husband and wife with no reference to the farming partnership in the title.

- The farming partnership consists of Alan and Joan.

- An RCI entry is not necessary as both Alan and Joan are named in the title and no other partner exists .

More information

Diagrams setting out examples of how the RCI regulations apply where land is owned or leased by or on behalf of a partnership can also be found in the Scottish Government’s explanatory document.

Additional information on RCI regulations

The Scottish Property Professional Support Lawyers Group (SPPSLG) has prepared an article on the RCI regulations 2021 working with Registers of Scotland.

Find out more about the SPPSLG article

| Previous | Next |