What is an overseas entity?

The regulations state that an overseas entity means a body corporate, partnership or an unincorporated body that is a legal person under the law by which it is governed and which is incorporated or constituted under, and governed by, a law other than the law of the United Kingdom.

An overseas entity is likely to be an entity whose main place of business is outside of the United Kingdom.

What information does RCI need?

RCI follows the internationally accepted best practice for identifying control of corporate entities.

If the overseas entity is the owner of land or tenant under a registered or recorded lease of more than 20 years, known in RCI as a recorded person, information is needed on:

- the overseas entities name

- the overseas entities registered number, if they have one

- what type of entity it is, for example, a partnership or overseas entity

- a contact address for the entity

- how they own the land – are they owner or tenant, and do they own the land in a certain capacity, for example, as a trustee?

More information on recorded persons can be found in the about recorded persons article.

For the person with controlling interest over the overseas entity, known in RCI as an associate, information is needed on:

- their name

- a contact address of the registered office

- their registered number

- what type of entity it is, for example, a partnership or unincorporated body

- the date the association between the overseas entity and the associate started, if known

- unique reference number, known as the Associate Reference Number, if they have been previously added to RCI, these are allocated after an associate’s details are first entered in RCI

- if the associate is subject to a transparency regime

If the associate is an individual RCI also requires:

- the associate’s date of birth, this will not be shown on the register

More information on associates can be found in the about associates article.

Exceptions for RCI

RCI does not apply where a person’s relationship to the overseas entity is only that of:

- a director of the entity, who is not an employee.

- an employee, other than a director.

- a paid professional such as a solicitor or accountant.

- a person acting under third party commercial or financial agreement – for example a customer or a supplier

- a creditor for example holder of a standard security

- a person exercising a function such as regulator, liquidator or receiver.

A detailed list of the exceptions for overseas entities for RCI can be found in Part 5 of Schedule 1 of the RCI regulations.

Schedule 2 lists persons subject to other transparency regimes who are out of scope of reporting to RCI. This includes overseas entities which have shares admitted to trading on a regulated market in an EEA state or other markets listed in legislation. See paragraphs 2(9) & (10) of Schedule 2.

Identifying associates of an overseas entity

There are 4 ways in which a would-be associate can consider whether or not they are an associate and therefore if registration is required.

If a person:

- directly or indirectly holds more than 25 per cent of the voting rights in the recorded person,

- directly or indirectly holds the power to appoint or remove a majority of the board of directors of the recorded person, or if it doesn’t have a board, the equivalent management body,

- has the right to exercise, or actually exercises, significant influence or control over a partnership or unincorporated body which is not a legal entity or a trust, but in respect of which head would apply if the partnership, body or trust were an individual

- has the right to exercise, or actually exercises, significant influence or control over the decision-making of the recorded person, particularly in respect of its dealings with the land.

The set up of the overseas entity will be a factor in determining the associates. In some cases, the associate will be individuals and in others, it will be another entity or entities, or it could be both.

Complexities exist where title to land is held by an overseas entity which in turn is owned by another overseas entity. To determine who the associates are will require consideration to be given to this chain of overseas entities and the terms of Part 5 of the Schedule 1 of the RCI regulations. The Scottish Government’s explanatory document provides examples of these scenarios.

Sometimes an overseas entity will own or tenant land as a trustee or a partnership. In these cases, the overseas entity will require to determine and disclose all of their associates. They may have associates because they are an overseas entity and have associates because they are trust or a partnership. The resulting entry for the recorded person in RCI will not disclose how each associate was determined. Where an overseas entity is acting as a trustee of a trust or as a partner in a partnership, they must register in RCI in the overseas entity category rather than choosing trustee or partner.

Register of Overseas Entities (ROE) and how it affects RCI

A registration of an overseas entity in ROE will not remove any duty on the overseas entity should they be required to register in the RCI.

When RCI and ROE were initially in policy development the view of both the Scottish Government and the UK Government was that double reporting should be avoided where possible. Our current understanding is that this has not changed and that the Scottish Government will consider the extent of duplication once the new ROE is operational has had time to embed and then decide whether it is appropriate to amend the RCI regulations.

It’s important to note that in the meantime overseas entities that are in scope of RCI must register irrespective of ROE and make arrangements to comply with RCI legislation.

You can find out more about ROE.

Examples of recorded persons and associates within an overseas entity

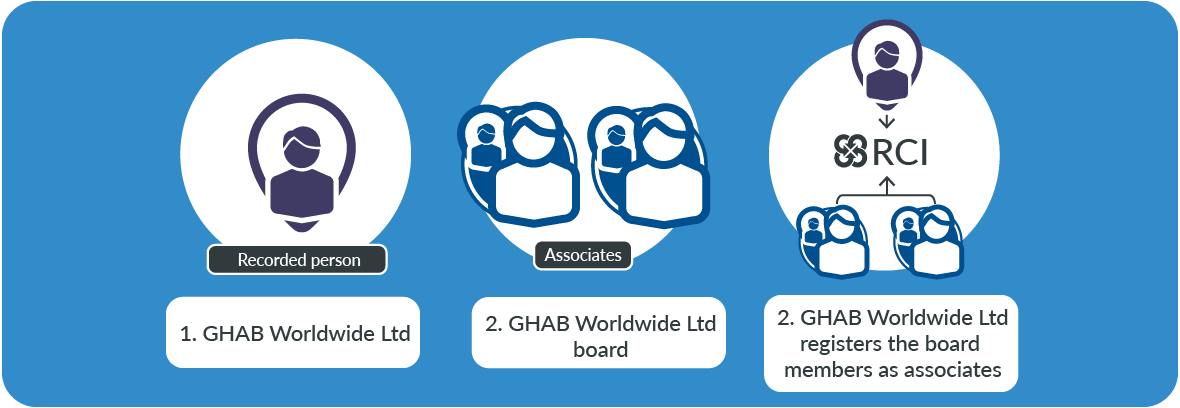

- GHAB Worldwide Ltd is an overseas entity that is registered in the Cayman Islands. For RCI, GHAB Worldwide Ltd would be the recorded person.

- GHAB Worldwide Ltd has 2 board members, each with 50% voting rights. For RCI, the 2 board members would be associates.

- GHAB Worldwide Ltd would need to register each board member as associates.

Other examples of significant influence and control include, where:

- a person has absolute rights to take or veto decisions related to the running of the business of the overseas entity,

- a person’s recommendations are always or almost always followed by shareholders who hold the majority of the voting rights in the overseas entity

- a person is significantly involved in the management and direction of the overseas entity

Diagrams setting out examples of how the RCI regulations apply where land is owned or leased by overseas entities can also be found in the Scottish Government’s explanatory document.

Additional information on RCI regulations

The Scottish Property Professional Support Lawyers Group (SPPSLG) has prepared an article on the RCI regulations 2021 working with Registers of Scotland.

Find out more about the SPPSLG article

| Previous | Categories of ownership or tenancy Homepage |