What is an individual?

For the purposes of part 1 of Schedule 1 of the Register of Persons Holding a Controlled Interest in Land (RCI) regulations, an individual refers to a natural person acting in their own right. An individual does not include:

- non-natural persons or

- a person acting in another capacity such as a trustee of either a trust or an unincorporated body or a partner in a partnership

In summary, an individual can be a living person but not an organisation.

Individuals and RCI

Individuals will have to register as a recorded person with RCI if:

- they are an owner or tenant (under a registered or recorded lease of more than 20 years) of the land and is, therefore, a recorded person AND

- the individual has entered into a contract or other arrangement with the associate, under which

- the recorded person owns or tenants the land for or on behalf of the associate, or

- the associate has the right to exercise, or actually exercises, significant influence or control over the recorded person’s dealings with the land

Further information can be found in part 1 of schedule 1 of the RCI regulations.

The Regulations are not intended to capture those who own their own home, where there is no one who has significant influence or control over them.

Who is in scope?

In each case, the parties will need to consider their own circumstances and the details of the contract or other arrangements to determine if they fall within the scope of RCI.

This will depend on whether the contract or arrangement has significant influence or control over the recorded person's dealings with the land. Dealings with the land refers to disposing of, creating real rights over, leasing or changing the use of the land.

Some contracts and arrangements will not amount to significant influence and control over the land. Determining whether there is an associate will depend on the level of control and that will turn on the individual terms of the contract or arrangement.

Our view is that a normal exclusivity agreement is unlikely to be in scope as it would not constitute significant influence and control.

There are a number of contractual and other arrangements which are not in scope. These are provided below.

Who is not in scope?

RCI does not apply where one or more of the following is, or are, the only contractual or other arrangements between the person and the individual. This applies if:

- the person’s contract or arrangement with the individual is one to which another Part of schedule 1 applies; this means that if the contract or arrangement is, for example, a trust or partnership arrangement, then the route to determining whether there is an associate will be by applying Part 2 or 3 of schedule 1

- the person’s relationship to the individual is that of

- a creditor of the individual, such as the holder of a standard security, or

- a paid professional advisor to the individual, such as a solicitor or an accountant,

- the person is the landlord of the individual

- the land is owned in common by the person and the individual

- the land is tenanted jointly by the person and the individual

- the person’s contract or arrangement with the individual is in the form of concluded missives for the sale of the land by the individual to the person where the title to the land has not been transferred to the person,

- the person has been appointed under a power of attorney granted by the individual in accordance with section 15 of the Adults with Incapacity (Scotland) Act 2000 (“the 2000 Act”)

- the person has been appointed as a guardian in respect of the individual under a guardianship order (within the meaning of section 58 of the 2000 Act),

- the person’s contract or arrangement with the individual is one to which the Timeshare, Holiday Products, Resale and Exchange Contracts Regulations 2010 apply,

- the person’s contract or arrangement with the individual is that of a service agreement, that is, where the person is the employee of the individual and occupation or possession of the land is provided to the person by the individual in return or part return for the performance by the person of services under an employment agreement, for example, in a "tied house" scenario

- the person’s contract or arrangement with the individual is as a liferenter under a proper liferent registered or recorded under section 51 of the Land Registration (Scotland) Act 2012

- the person’s contract or arrangement with the individual is an agreement as to the financial provision to be made on divorce or the dissolution of a civil partnership, between the person and the individual, as the case may be

- the person’s contract or arrangement with the individual is a cohabitation agreement, that is, an agreement between two persons living together as if they are spouses

- the person has a personal real burden, within the meaning of section 122(1) of the Title Conditions (Scotland) Act 2003) over the land that is owned or tenanted by the individual, this includes a right to pre-emption

- the person is the holder of a licence which grants the right to use or exploit land, or any part of land owned or tenanted by the individual

- the person possesses a right of occupation over land owned or tenanted by the individual without any form of payment or other consideration being required in return.

A more comprehensive list can be found in Paragraph 2 of Part 1 of Schedule 1 of the regulations. This list of exceptions is NOT exhaustive.

Information RCI requires for individuals

For RCI, information about individuals is needed for both the owner or tenant, known as the recorded person, as well as the person with a controlling interest, known as the associate.

Information about recorded persons

RCI requires the recorded person’s:

- name and address of a recorded person, and if relevant, their registered number (for example, company number)

- title number of the land, or where the land is not in the land register, a description of the land enough to allow it to be identified

- details of the capacity in which the recorded person owns or leases the land. This would include, for example, where an individual owns the land in their capacity as a trustee

- the required details in relation to each associate or, where a security declaration has been made, a statement of that instead

Information about associates

RCI requires the associate's:

- date (month and year) on which the association with the recorded person started or a statement that the date is not known.

- name

- contact address

- date of birth, this will not be shown on the register and is only needed when the associate is an individual

- registered number (e.g. company number), only where the associate is a non-natural person (for the purpose of identifying them)

- the paragraph of Schedule 2 that applies only where the associate is an entity listed in Schedule 2 transparency regimes

If the associate has been previously added to the register RCI also requires:

- unique reference number, known as the associate reference number, these are allocated after an associate’s details are first entered in RCI

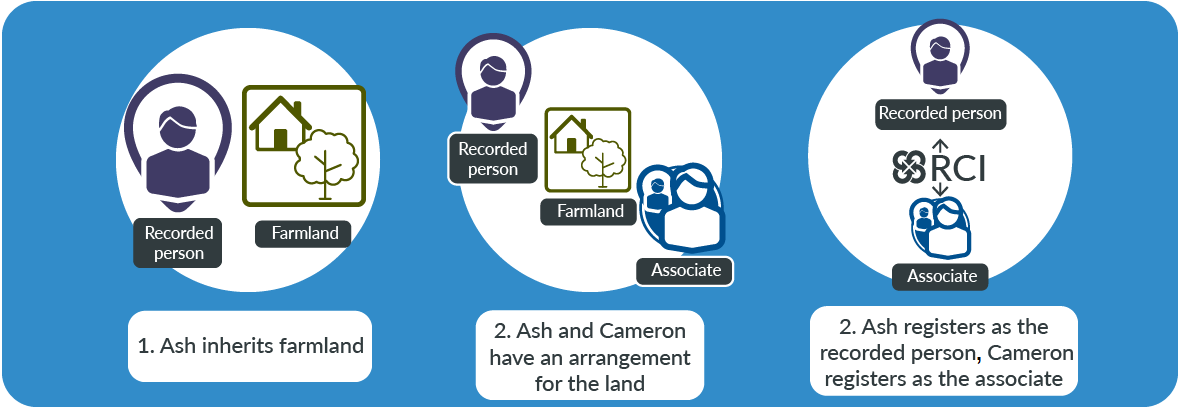

Example of a recorded person and associates for an individual

Example 1

The following is an example of an individual who does have an associate.

- Ash owns an area of farmland that they inherited from their uncle. They are named on the title as the owner of the land, although they don’t live in the area.

- Their father, Cameron, has an arrangement with Ash to use the area as part of his adjoining farm. Ash has no involvement with the area of farmland and would act on any instruction given by their father in respect of any dealings with the land.

- Ash is in scope of RCI as they act on the recommendations of their father only. Ash is the recorded person and their father, Cameron, is the associate.

Example 2

The following is an example of individuals who do not have an associate.

- Alan and Joan are a couple who own their own home. They are named as owners on the sasine register.

- There is no one who has significant influence or control over either Alan or Joan.

- Alan and Joan do not need to register in RCI.

Example 3

The following is an example of an individual who does not have an associate.

- Harry and Nicola are a couple who live together. It is only Harry who owns the house and he is named as sole owner on the land register.

- Although Nicola is not named on the land register the regulations are not intended to impact upon owner-occupier situations in which only one party is registered as the owner of the land.

- Harry is not a recorded person and does not need to register in RCI.

Additional information on RCI regulations

The Scottish Property Professional Support Lawyers Group (SPPSLG) has prepared an article on the RCI regulations 2021 working with Registers of Scotland.

Find out more about the SPPSLG article

| Next |